Finance Bariatric Surgery in Mexico (2024)

Are you ready to shed that excess weight but are short on cash? Find out options to finance bariatric surgery in Mexico. Get quality care from board-certified surgeons and all-inclusive packages for your weight loss surgery without breaking the bank!

Financing Options for Weight Loss Surgery in Mexico

You can pay the cost of weight loss surgery in Mexico with different financing options.

There are many ways to finance bariatric surgery in Mexico.

You can select options to finance bariatric surgery in Mexico that best suit your needs and are available in your country.

Keep reading to explore the options in detail.

Financing Weight Loss Surgery in Mexico for U.S. Citizens

Supermoney

Supermoney is a platform that helps you compare the best loan options available to you. You can select from various lenders for financing weight loss surgery in Mexico.

Key Features:

Highlights:

PayPal

PayPal provides a reusable line of credit to pay your expenses over time. You can use PayPal credit to finance bariatric surgery in Mexico.

Key Features:

Highlights:

eMedical Financing Solutions

eMedical Financing Solutions offers flexible financing options for different credit levels.

Key Features:

Highlights:

Financing Weight Loss Surgery in Mexico for Canadian Citizens

Medicard by iFinance

Medicard offers several loan options with instant approval for bariatric patients in Canada.

Key Features:

Highlights:

Financing Weight Loss Surgery in Mexico for Australian Citizens

Total Lifestyle Credit

TLC provides financing plans to cover your bariatric surgery needs and related costs.

Key Features:

Highlights:

How Do I Qualify for Weight Loss Surgery Loans?

When looking to finance bariatric surgery in Mexico, consider these factors in making your decision:

According to FICO, most loan providers prefer borrowers with at least fair credit scores (580 to 699). If your credit score is low, consider applying with a co-signer.

Check your credit score now!

How Can I Finance Weight Loss Surgery in Mexico?

At MBS, we help you tailor an affordable loan to finance bariatric surgery in Mexico with ease.

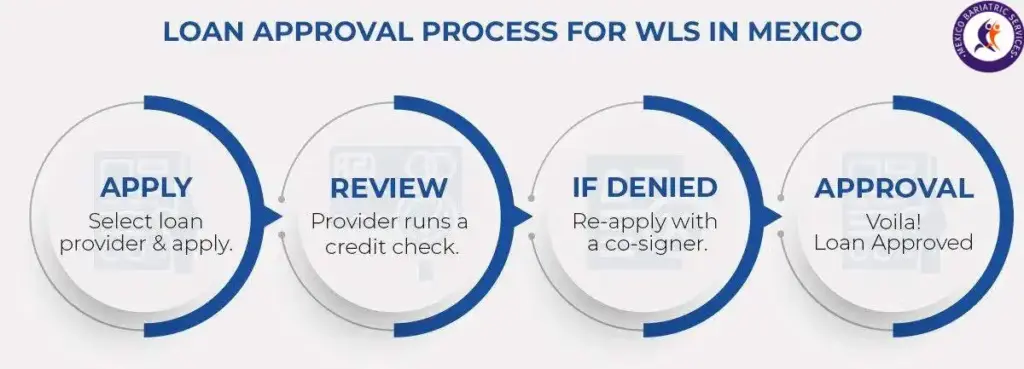

Typically, the loan approval process for weight loss surgery in Mexico includes the following.

- Application: Select the loan provider of your choice and complete the application process.

- Review: Your loan provider runs a credit check once they receive your application.

- If Denied: In case your request is denied, consider re-applying with a co-signer.

- Approval: After you get approval, you’ll receive the amount you requested for your surgery.

Tip: Choose only one company to apply for the loan. Your credit score lowers every time you request to review your credit report.

Finance Bariatric Surgery in Mexico With Bad Credit

Apply with a Co-Signer

Look for “Bad Credit Loans”

Repair your Credit Score

It is essential to find out your credit score before making a loan application. It will help you to deal with the factors that could bring down your score.

Paying for your bariatric surgery is simple with MBS. Find out the various payment options we offer that suit your needs best!

Mexico Bariatric Surgery Payment Options

At MBS, we offer multiple payment options for weight loss surgery in Mexico.

Conclusion

MBS offers flexible options that match your needs to finance bariatric surgery in Mexico. Get top-notch care from board-certified surgeons in Mexico without going too far from your budget!