How to Finance Weight Loss Surgery in Mexico?

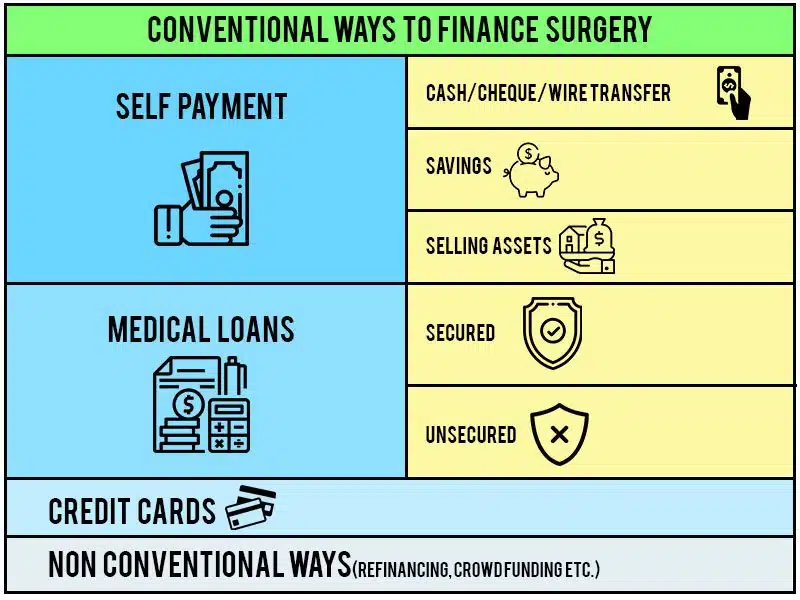

Here are some options to finance bariatric surgery in Mexico.

Medical Loans for Bariatric Surgery

- Numerous banks and financial institutions offer medical loans to people in need of funds to pay for bariatric surgery.

- While most of the loans are unsecured (requiring no collateral), some may be secured.

- The rate of interest charged is higher in the case of unsecured loans because of high lender risk.

- At Mexico Bariatric Services, we facilitate medical loans through eFinancing Solutions.

- For Canadians, we work with Medicard.

1. Personal Loans (Credit Cards) for Financing Weight Loss Surgery in Mexico

- Another way to finance weight loss surgery is by getting a personal loan from a credit card facilitator.

- An example of this is Discover.

- While the interest rate charged can be on the higher side, this option has fewer formalities.

- Some of the leading credit card companies offering credit for medical treatment are CareCredit, MedKey, AccessOne MedCard, Citi Health Card, and Wells Fargo Health Advantage Card.

- Mexico Bariatric Services has tie-ups with United Medical Credit for unsecured loans.

2. Self-Pay Bariatric Surgery

- You can self-finance your bariatric surgery, provided you either have adequate savings or adequate income.

- Paying out-of-pocket for bariatric surgery is usually opted by those with sufficient liquid assets.

3. Loans from Friends and Family

- You can also turn to their friends or family to borrow funds for financing their weight loss surgery.

- Usually, money borrowed from friends and family doesn’t require payment of interest and is an easy route to raise funds.

4. Proceeds from the Sale of Assets

- One may resort to selling off assets that aren’t of much use to them.

- This route frees the individual from the burden of repaying the money in the future.

- It is hassle-free and does not carry any interest.

5. Refinancing for Bariatric Surgery

- Refinancing refers to replacing a previous loan with a new loan.

- You can either use refinancing to switch to a lower rate of interest, or you can extend your payoff date. In this way, you end up paying less in principal amount every month.

- Some of the clients of Mexico Bariatric Services chose to refinance their housing loans for medical loans.

6. 401(k) loan

- You can take a loan from yourself by using your retirement funds with 401 (k) loans.

- You can borrow at the most 50% of your money or $50,000, whichever is lower.

- You have to repay the funds in the form of monthly payments + interest. There may be a maintenance and set-up fee involved as well.

Consider all the risks involved with the 401(k) loan type as your future retirement funds are being consumed.

7. Crowdfunding to Finance Bariatric Surgery

- Crowdfunding is the phenomenon of raising money from a large number of people using an online platform.

- Crowdfunding platforms are websites dedicated to fundraising for a cause.

- People use these platforms to showcase their fundraising story, which quite often resonates with potential philanthropists.

- People seeking to raise funds for their bariatric surgery can come up with a compelling pitch for their motivation, reasons, and aspirations for weight loss surgery and look forward to contributions from the general public.

- Some leading crowdfunding websites are GoFundMe, GiveForward, and YouCaring.

Medical Tourism and Weight Loss Surgery in Mexico

- Many people now opt for medical tourism to get affordable and quality bariatric surgery outside their home country.

- Gastric bypass and gastric sleeve in Mexico are an obvious choice for people from the US and Canada because of geographical proximity.

- While the average cost of bariatric surgery in the United States is about $25,000, the price of weight loss surgery in Mexico begins from $3,350.

- Mexico Bariatric Services facilitates surgery in Tijuana, Cancun, and Mexicali.

- It has a highly renowned panel of bariatric surgeons which has treated many medical tourists to their satisfaction.

{

“@context” : “http://schema.org”,

“@type” : “Article”,

“headline” : “How to Finance Weight Loss Surgery in Mexico?”,

“author”: “Aranza”,

“image” : “https://www.mexicobariatricservices.com/kb-old/wp-content/uploads/2018/06/Loans-for-Bariatric-Surgery-in-Mexico.png”,

“datePublished”: “2018-09-20”,

“publisher”: {

“@type”: “Organization”,

“name”: “Mexico Bariatric Services”,

“logo”: {

“@type”: “ImageObject”,

“url”: “https://www.mexicobariatricservices.com/wp-content/uploads/2019/08/MBS-Logo-1.png”

}

},

“articleSection” : “How to Finance Weight Loss Surgery in Mexico?”,

“articleBody” :”Numerous banks and financial institutions offer medical loans to people in need of funds to pay for bariatric surgery. Another way to finance weight loss surgery is by getting a personal loan from a credit card facilitator. One may choose to self-finance their bariatric surgery, provided they either have adequate savings or adequate income. One may also turn to their friends or family to borrow funds for financing their weight loss surgery.One may resort to selling off assets that aren’t of much use to them.Refinancing refers to replacing a previous loan with a new loan.Government loans are a convenient way to finance surgery as they are at a lower rate of interest.Many people now opt for medical tourism to get affordable and quality bariatric surgery outside their home country.Crowdfunding is the phenomenon of raising money from a large number of people using an online platform.”,

“url” : “https://www.mexicobariatricservices.com/knowledgebase/bariatric-surgery-financing-mexico/”

}